FIRE Accounts Starting Balances

Included in this issue of The FIRE Letter:

- Fidelity Beginning Balance - Mutual Fund FIRE Portfolio

- Charles Schwab Beginning Balance - ETF FIRE Portfolio

- YTD Performance Update for Both Portfolios

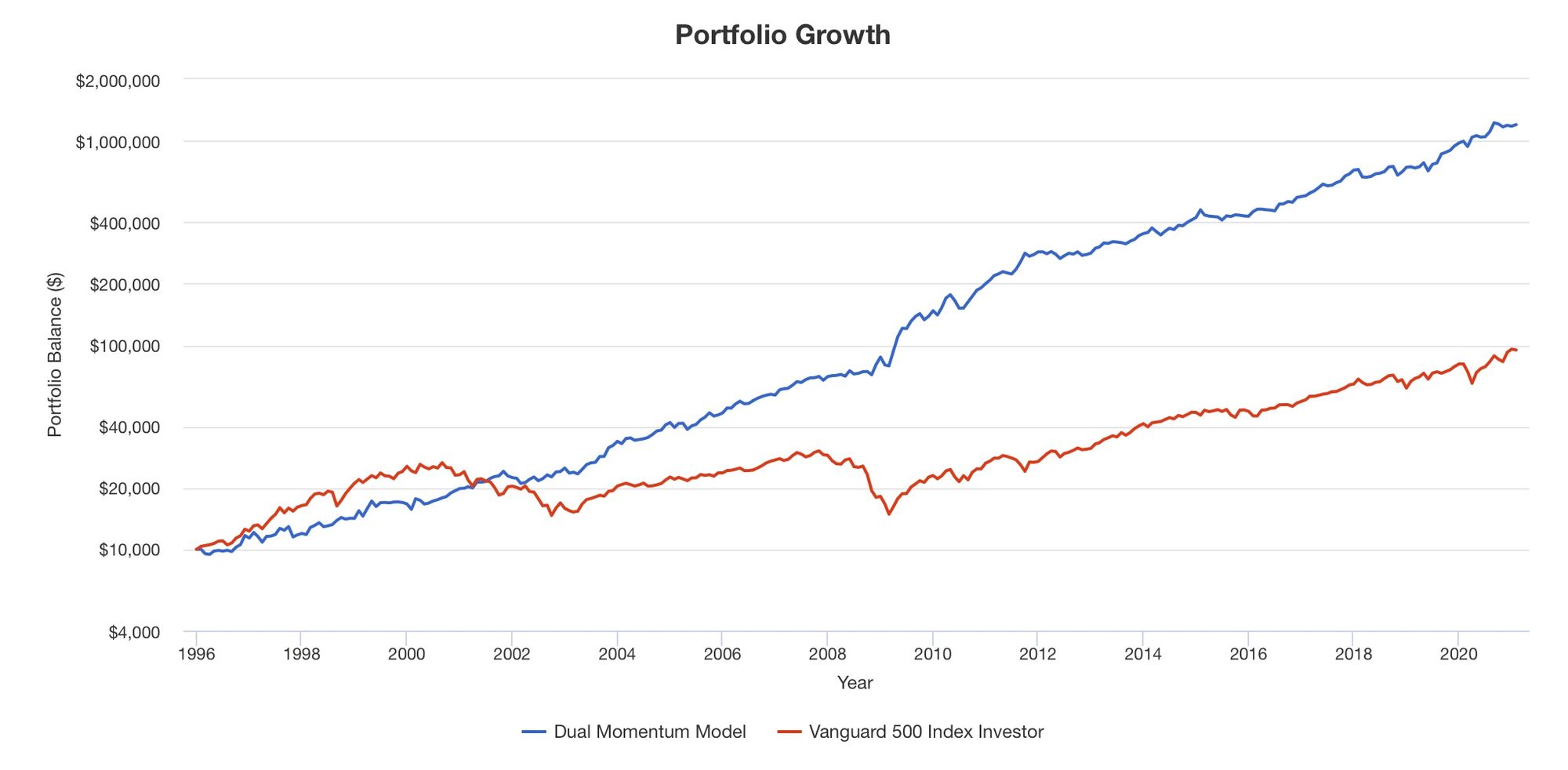

In the future as we progress through the months and years, I expect to post images like the one below showing a nice equity curve of my FIRE portfolios (blue line) compared to the S&P 500 (red line).

However, and I emphasize this, I want portfolio performance reports to show actual returns of an actual portfolio with real money. The only way I can do that is to invest real money following The FIRE Letter model trades. I’m already doing that!

I’ve said that I will have skin in the game by investing some of my own money to follow my trades published here. So I captured screenshots of my year-end balances for my two Roth IRA accounts that I’m using for The FIRE Letter portfolios.

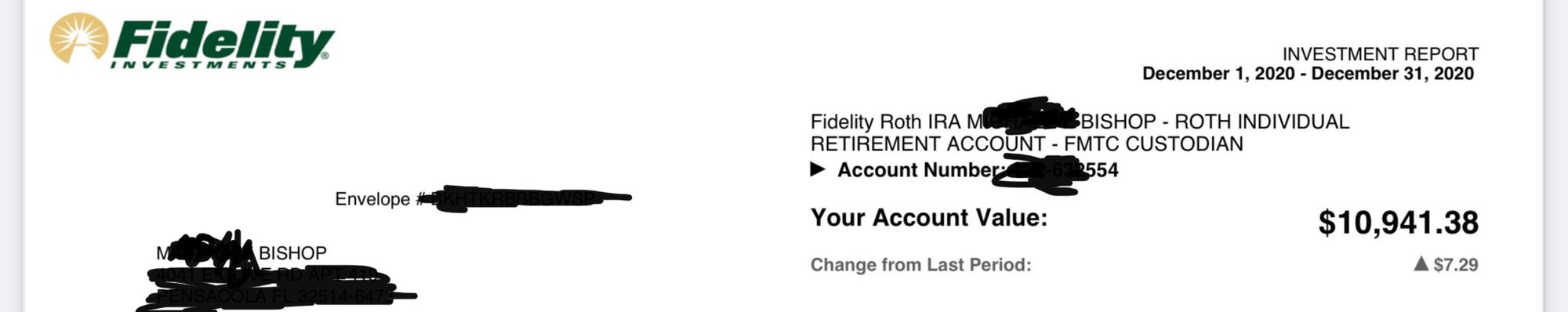

One of the brokerages I use is Fidelity Investments. They are consistently rated very highly by industry experts and their mutual funds are well managed. They also offer a broad selection of sector funds.

Fidelity Mutual Funds FIRE Portfolio

The first account that I’m using for my journey in this newsletter is with Fidelity. I moved some money out of it last year and was planning to get it down to exactly $10,000 for the end of year balance, however, I inadvertently left about $900 extra. The 2020 end of year balance was $10,941.38, so that becomes the beginning balance for my mutual fund FIRE portfolio. Below is a screenshot of a portion of my end of year statement.

You can see I didn’t blot out some of my info very well. I intended to buy a stylus pen while running errands, however, I kept forgetting. I’ll get one before I need to post any more statement images.

To summarize, my FIRE Fidelity account began with $10,941.38. I plan not to add/withdraw any more funds to/from this account.

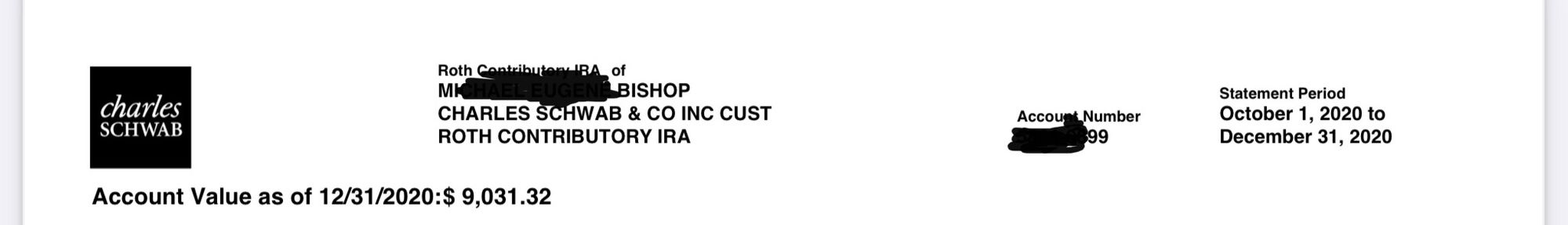

Charles Schwab ETF FIRE Portfolio

My second portfolio is for exchange-traded fund (ETF) trades rather than mutual funds. Other brokerages frequently impose trading fees for mutual funds managed by competing brokerages. Those fees can take a significant cut from your account if your trades are smaller amounts. The fees would be inconsequential if you trade larger amounts, but new investors with small balances probably wouldn't want to pay those fees.

This ETF portfolio account is at Charles Schwab. Charles Schwab is an excellent brokerage also consistently rated very highly by industry experts. My 2020 end of year balance in this account was $9,031.32, so that becomes the beginning balance for my ETF FIRE portfolio. Here is a screenshot of my end of year statement.

Same problem with neatness or lack there of. I’ll definitely get that stylus pen!

To summarize, my second portfolio, which is at Charles Schwab, began with $9,031.32. I plan not to add or withdraw any funds from this account.

YTD Performance

Both portfolios are off to a nice start for 2021. That should come as no surprise as the broad stock market indices are doing well.

My Fidelity FIRE portfolio’s account balance is currently $11,978.01. That’s a YTD increase of $1,036.63 for a 9.47% gain.

My Schwab FIRE portfolio’s account balance is currently $9,927.94. That’s a YTD increase of $896.62 for a 9.93% gain.

For comparison, the S&P 500 (using Vanguard’s VFIAX fund as a proxy) is up 4.95% YTD.

So far, my FIRE Models are looking pretty good, but this short term comparison doesn’t mean much. It’s good news of course and I'll certainly take it, but the markets as well as my portfolio fund selections will vary day to day, week to week, and month to month. I'm more concerned with the long term view. It’s a nice start to my journey though!

FIRE Accounts Starting Balances - Recap

To recap, this article establishes the starting balances for my two FIRE portfolios, shown again below:

- Fidelity Mutual Fund FIRE Portfolio starting balance - $10,941.38

- Charles Schwab ETF FIRE Portfolio starting balance - $9,031.32

Thanks for reading!

Talk with you soon,

Mike